The Tax Special Interest Group (SIG) is tasked with developing a supportive and productive environment for tax academics and practitioners in Australia and New Zealand who are engaged in or wish to engage in tax research and/or teaching. The Tax SIG will aim to encourage research and education in tax and foster relationships with industry to improve and contemporise academic contributions.

- to provide a forum for members to express and discuss current educational and professional issues in tax. This will be achieved via keynote presentations and panel sessions involving leading tax academics and practitioners at the annual SIG meeting.

- to provide an opportunity for members to present research papers on emerging issues or methodologies in tax. This will be achieved via research presentations at the annual SIG meeting or an online series.

- to provide an opportunity for members to present research proposals and/or work-in-progress to garner feedback from a supportive and learned group of researchers. This will be achieved via workshops at the annual SIG or throughout the year.

- to provide an opportunity for early career members to present their research. This will be achieved via a targeted call for papers for the annual SIG meeting or an online series.

- To provide an opportunity for members to establish networks, find collaborators and seek mentors from within the Tax SIG. This will be achieved by organising social events following the annual SIG meeting.

- to disseminate information from stakeholders to Tax SIG members. This will be achieved via a periodic newsletter to members.

The Tax SIG will meet annually immediately prior to the AFAANZ annual conference, with additional ad hoc workshops and presentations scheduled throughout the year as needed or required.

Members of the Tax SIG comprise higher degree students, academics and practitioners with an interest in any area of taxation, for example: tax policy, tax compliance and morale, taxation of individuals, taxation of entities, international tax, capital gains tax (CGT), goods and services tax (GST), taxation of superannuation and indirect taxes etc.

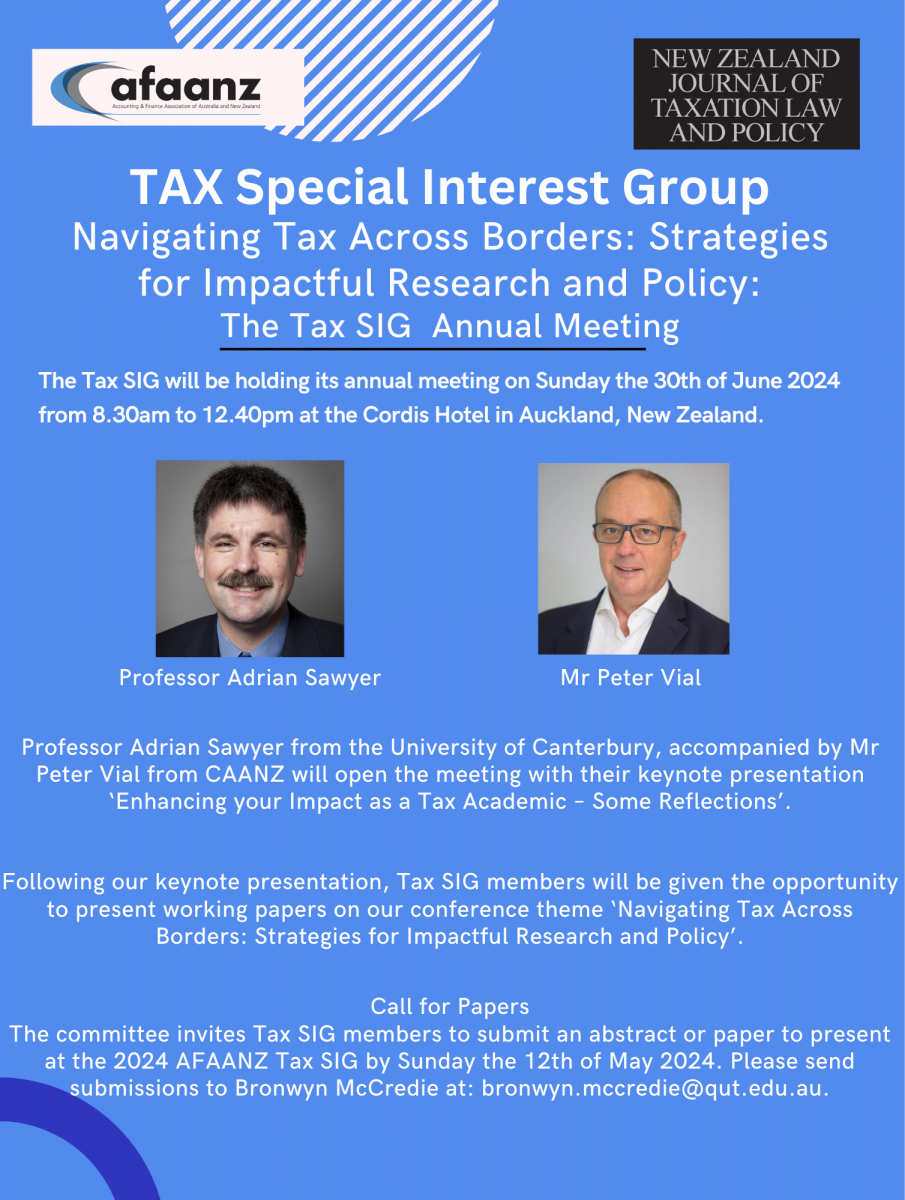

Professor Adrian Sawyer from the University of Canterbury, accompanied by Mr Peter Vial from CAANZ will open the meeting with their keynote presentation ‘Enhancing your Impact as a Tax Academic – Some Reflections’. A brief synopsis of this presentation follows:

Increasingly, academic institutions and funding bodies (amongst others), are asking for evidence of the impact of our research as academics. What do we mean by research impact? How do we demonstrate the evidence of our impact? Through what lens should we be viewing impact? These are significant questions. Research impact is defined by the ARC (Research Discovery program) as “…the demonstrable contribution that research makes to the economy, society, culture, national security, public policy or services, health, the environment, or quality of life, beyond contributions to academia.” Research impact is a core factor for determining funding allocations in other jurisdictions, such as in Australia (the former ERA), New Zealand (PBRF) and the United Kingdom (REF). Research impact has been equated with journal impact factors. These measure the importance of a journal by calculating the number of times selected articles are cited within a defined period. Research impact extends well beyond this narrow measure that largely limits the assessment of impact to within academic circles.

In this presentation, Adrian will traverse the questions set out above. He will also suggest ways in which research impact can be presented and evaluated. This includes developing case studies that tell a story of how our research has been applied, interpreted and utilised beyond academia. Using blogs and similar platforms are becoming increasingly important platforms for making our research visible to wider society. We can also work with the relevant professional bodies, governments, policy makers and actively engage with wider society (through breaking down the ‘silos’ and demonstrating that academic research has real world implications). The presentation will also acknowledge the challenges (tax) academics face in assessing, enhancing and demonstrating how their research is relevant to wider society.

Accompanying this presentation will be a perspective from a representative of a major portion of society that can benefit from the findings of academic research, namely the accounting (tax) profession. Specifically, it will include the perspectives of Peter Vial from CA-ANZ.

Following our keynote presentation, Tax SIG members will be given the opportunity to present working papers on our conference theme ‘Navigating Tax Across Borders: Strategies for Impactful Research and Policy’.

Call for Papers

The committee invites Tax SIG members to submit an abstract or paper to present at the 2024 AFAANZ Tax SIG by Sunday the 12th of May 2024.

Authors will be notified of their acceptance to present at the 2024 AFAANZ Tax SIG by Sunday the 26th of May 2024.

Please send submissions to Bronwyn McCredie at: bronwyn.mccredie@qut.edu.au.

Papers that wish to be subsequently considered for publication in the New Zealand Journal of Taxation Law and Policy should follow the NZ Law Style Guide (12,000 words maximum) and their submission processes. For further information please contact: service@thomsonreuters.co.nz.

We look forward to seeing you all in Auckland for what promises to be an impactful experience.

To apply for membership to the AFAANZ Tax SIG please click on the link below: https://www.afaanz.org/interest-group/tax-special-interest-group

‘Meet the Editors’ panel

Are you teaching or researching in the field of tax and wondering where to publish your research?

Are you a HDR student or ECR who would benefit from some tips and tricks on publishing?

Are you uncertain about the role of a reviewer?

If your answer is ‘yes’, please watch below for a ‘Meet the Editors’ panel with Professor Ellie Chapple (Queensland University of Technology) and Professor Adrian Sawyer (University of Canterbury).

The Tax SIG would like to thank its supporters:

MEMBERSHIP

To become a member of the Tax SIG you will first need to become a member of AFAANZ, The fee for AFAANZ membership is AU$148.50 including GST for applicants residing in Australia and AU$135 for applicants residing outside Australia. Note that membership is based on a calendar year.

The fee for the Tax SIG is AU$22 including GST for applicants residing in Australia and AU$20 for applicants residing outside Australia. Click on the purchase button to gain access to this SIG. You may also "Join this Group" further below to be keep up to date with the latest news and events.

You need to log in to your account to subscribe to this group.

Subscribe for Free

Getting your web user account is fast, free and lets you get a taste of the great content and resources available to our members.

- Access more articles and resources

- Subscribe to special interest groups to get content tailored to you

- Buy event tickets online