AFAANZ and CA ANZ are proud to present the 2025 AFAANZ Education Forum

How do we “balance the books” of influence in accounting education?

Join our panel of leading educators as they explore how universities, professional bodies, and government can work together to strengthen the impact of accounting education.

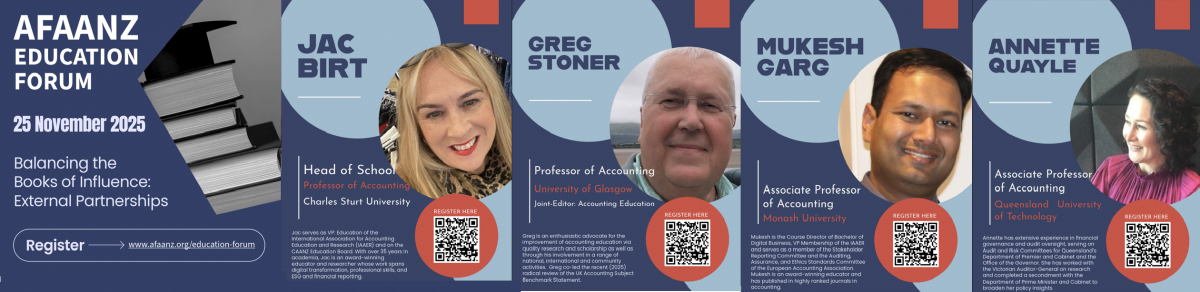

Featuring Jac Birt, Greg Stoner, Mukesh Garg, and Annette Quayle at the AFAANZ Education Forum — 25 November 2025.

Registration is now open for both events.

- AFAANZ Education Forum Date: Tuesday 25 November 2025

- Time: 10.00am to 3.00pm AEDT

- Registration Fee: $95 (for both AFAANZ & RMIT events: $130), PhD Students $65

- Where: Chartered Accountants Australia and New Zealand, 600 Bourke St, Melbourne

To register:

- For the RMIT Accounting Educators' Conference only ($50), click HERE (now closed)

- For the AFAANZ session only ($95), click HERE (now closed)

- For the AFAANZ session only for PhD Students ($65), click HERE

- For both the AFAANZ Education Forum and the RMIT Accounting Educator's Conference 2025 ($130), click HERE

Notes on registering for the above events:

- Click on "Click to Register Here" button above

- Click on Purchase Event button

- Click on Add to Cart button

- Click on Cart icon at top of page

- Check that the item is listed then click on Checkout button

- Login into your AFAANZ account (or create an account) and enter Billing Details if fields are empty then click Next button

- If all looks OK, click on Place Order button and it's all done!

- You will receive a confirmation email as well.

If you have any queries, contact info@afaanz.org

|